ClimateScore Global

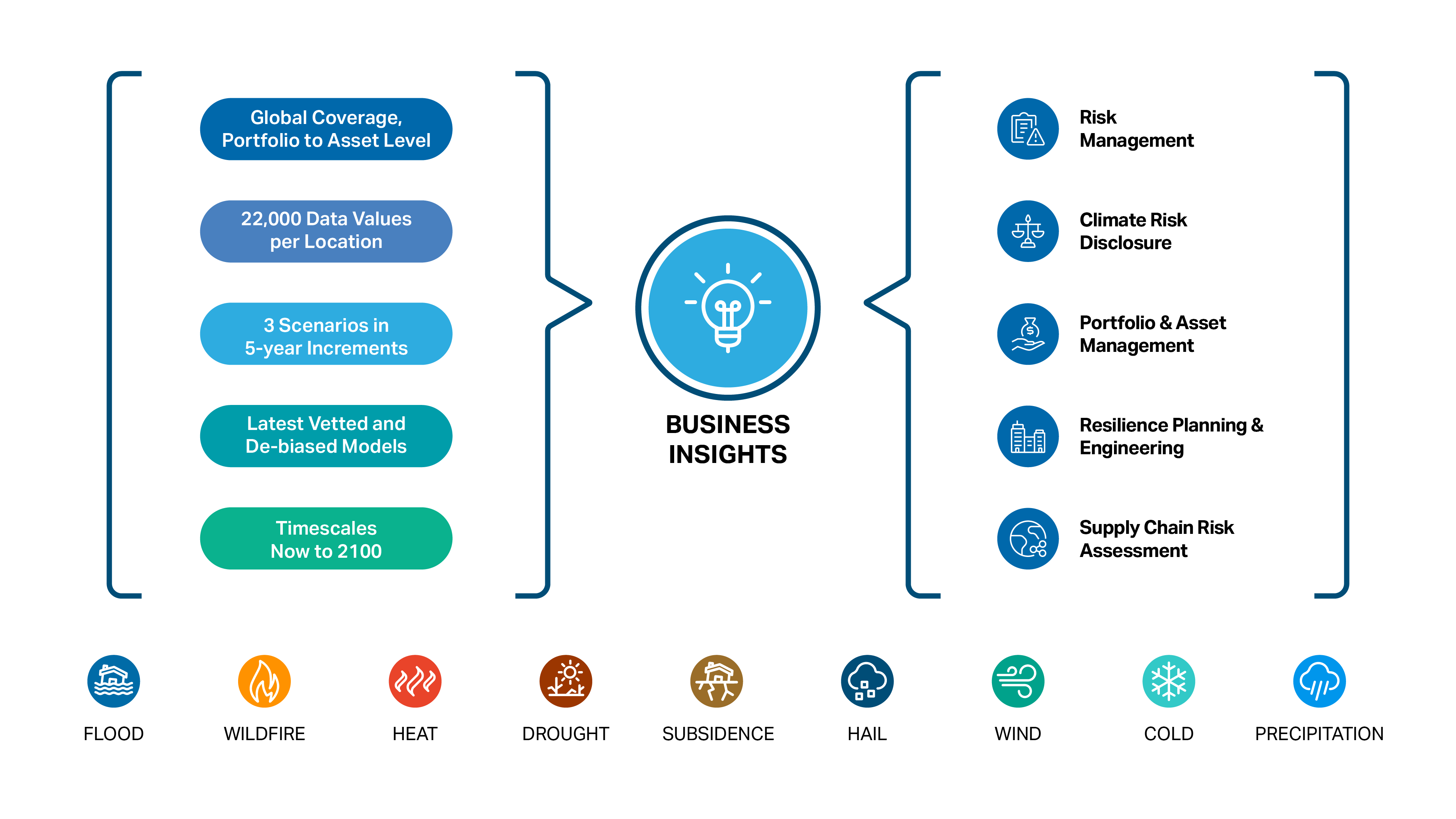

ClimateScore Global delivers decision-grade risk and adaptation analysis quickly, flexibly, intuitively; empowering you to assess exposure, model mitigation, and understand climate impacts to physical, corporate or financial entities anywhere on the planet. Built to support your day-to-day operations and protect your financial future.

Jupiter AI: Instant Insight. Infinite Impact.

ClimateScore Global's artificial intelligence agent—Jupiter AI™—represents a quantum leap in understanding physical climate risk, bringing speed and simplicity to how you access, analyze, and act on complex climate data.

Jupiter's MRM-validated climate models approve faster, and with confidence

The world’s most demanding banks have validated Jupiter models and methodology. Through rigorous testing and collaboration with Jupiter, they’ve integrated ClimateScore™ physical risk data into their enterprise risk management modeling frameworks. These engagements have forged Jupiter MRM Accelerator, which gives financial institutions everything they need to navigate model validation: fully documented models and layered analyses; a robust library of packaged validation tests for internal use; and a customizable rollout template, tailored to each institution’s MRM workflow.

Purpose-Built for Banks and Financial Institutions

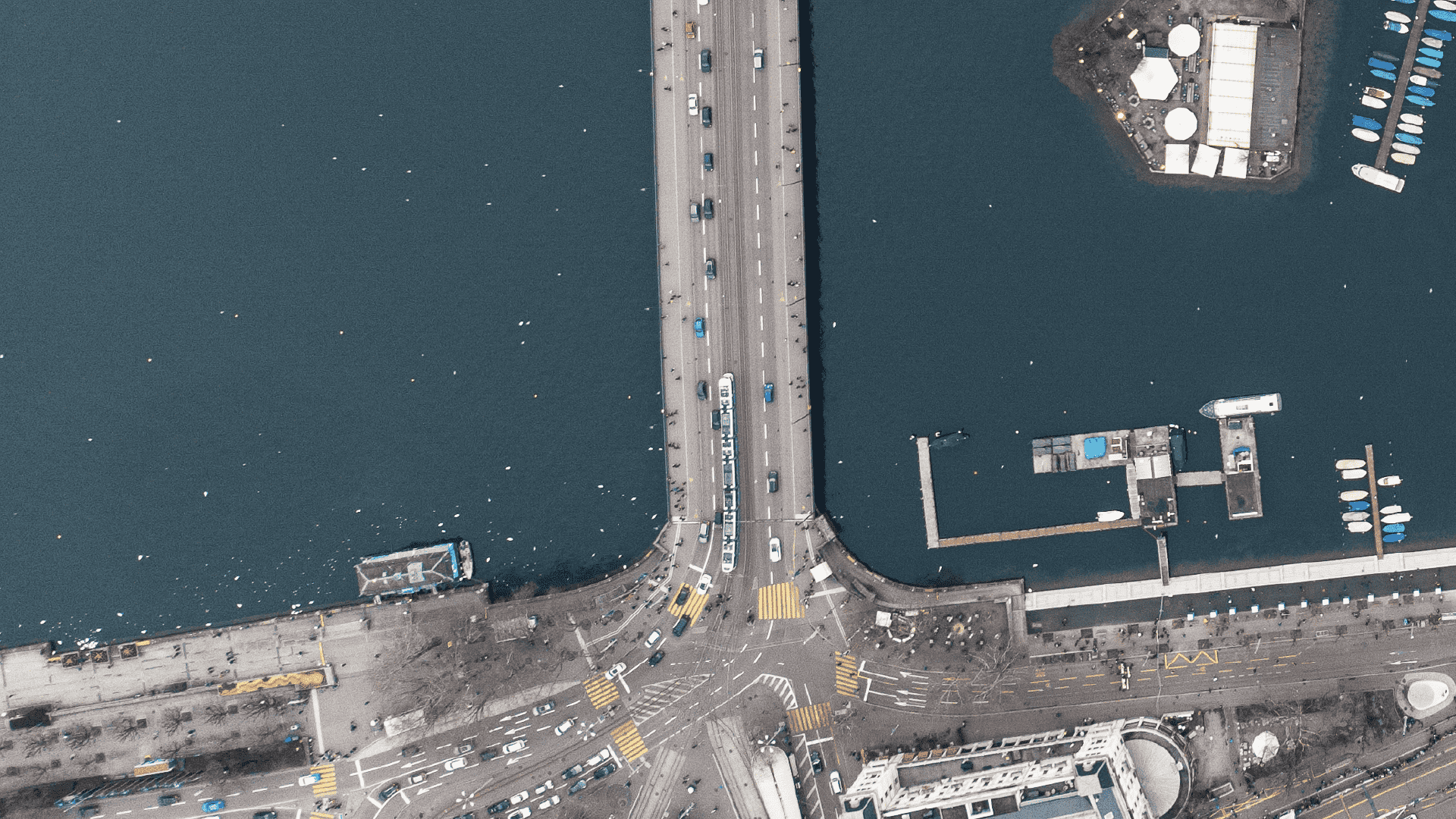

Financial institutions are on the front lines of managing economic risk—and climate change is reshaping that landscape. ClimateScore Global empowers financial institutions with the tools they need to understand and respond to physical climate risks across global portfolios. It helps identify exposure, pinpoint vulnerable assets and regions, assess how risks evolve over time, and uncover opportunities to strengthen resilience, meet disclosure mandates, and inform strategic decision-making.

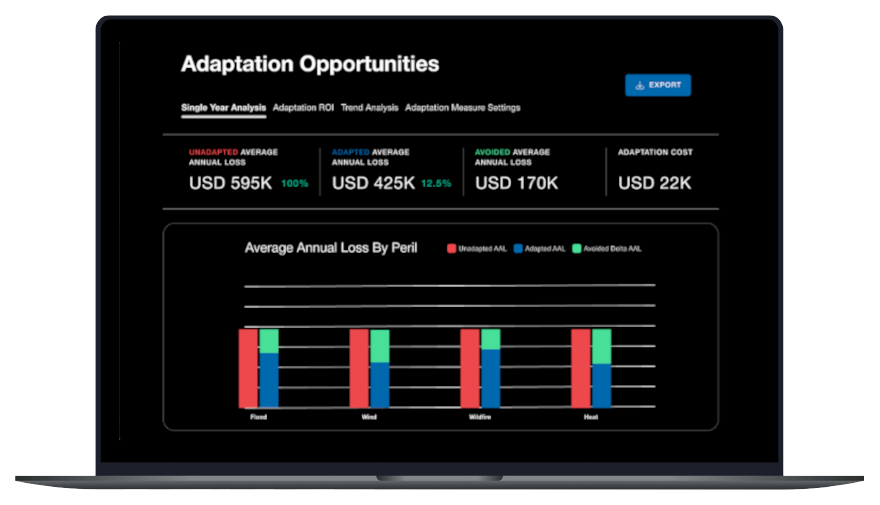

See and Assess Your Total Risk

ClimateScore Global is the most complete physical climate risk solution available. With access to over 22,000 peril and loss metrics, you can run multiple scenario analyses of any peril worldwide, in 5-year increments from now to the year 2100. Access to the best metric for your specific need (not the “next best”) eliminates unnecessary uncertainty in your projections and reporting.

Streamlines Physical Climate Risk Reporting

Jurisdictions are demanding that key players within their financial systems—from banks, insurance firms, and asset managers to publicly listed corporations—assess and account for future physical and transition climate risk.

As regulations and their add-on phases come into force, the number of companies who must comply multiplies—even large organizations based outside jurisdictional borders. If you do business in these regulated markets, you must prepare for climate risk disclosure.

Integrated within the Compliance Hub of ClimateScore Global, the CSRD Module provides a comprehensive and intuitive workflow to help companies navigate CSRD's stringent requirements. It empowers organizations to achieve compliance efficiently while strengthening business resilience.

.avif)

Understanding

Economic Impact

ClimateScore Global provides a comprehensive assessment of the direct financial impact of physical climate change on your operational, market and credit risk. By identifying and quantifying the financial impact of climate-related damage and its downstream effects, you can be better equipped to identify areas that are most vulnerable to climate risks and build climate resilience into your business.

What Sets Jupiter Apart

Gold Standard Climate Science

Trusted Industry Leader

Climate Risk Translator

Testimonials

Paired with a Jupiter expert that specializes in your industry, we will work together to assess your needs and determine the best-in-science physical climate risk analytics approach for your organization.

talk to an expert.webp)

.png)

%20(1).png)

.jpg)