.avif)

J.P. Morgan, Morgan Stanley Expect a Warmer Future

Several major banks have recently disclosed that they are making decisions based on the assumption that global temperatures will continue to rise — potentially well beyond international targets.

J.P. Morgan, for example, reports it “vets investments using ‘baseline’ scenarios that assume global warming of 2.7°C to over 3°C by the end of the century,” according to Scientific American.

Morgan Stanley echoed a similar outlook in a March 2024 analysis covered by The Guardian, stating plainly: “We now expect a 3°C world.”

These planning assumptions exceed the goals of the international Paris Agreement, which aimed to limit global warming to well below 2°C. But in light of current emissions trajectories, banks are bracing for the likely possibility that these goals won’t be met.

“These guys are not making assumptions out of the blue,” said Gautam Jain, a former investment banker interviewed by Scientific American. “They are following the science.”

A Surge in Climate Disasters

“Following the science” means preparing for a world where physical climate risks — such as extreme storms, floods, wildfires, and drought — are intensifying.

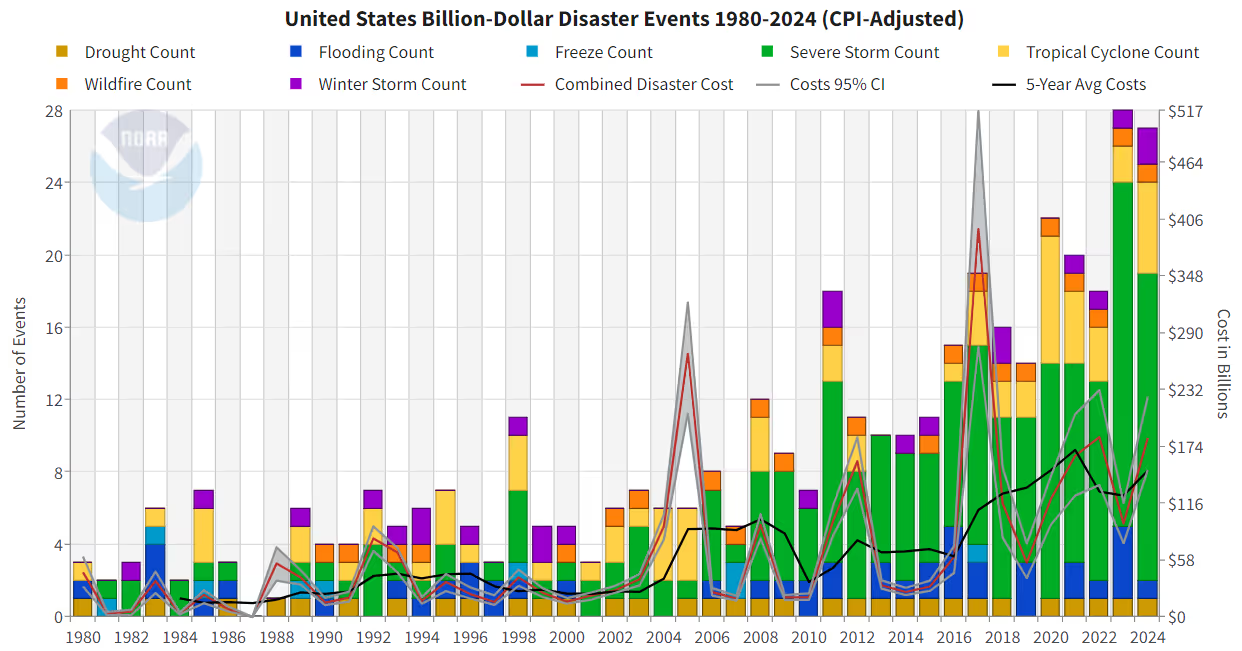

Since 1980, the National Oceanic and Atmospheric Administration (NOAA) has tracked 403 separate weather and climate disaster events in the U.S. that caused at least $1 billion in losses.

But here’s the kicker: 115 of those events — more than 28% — occurred just in the past five years.

This data shows a steep acceleration in the pace and cost of extreme weather, and banks with exposure to physical assets will increasingly feel the effects.

How Climate Disasters Impact Banks

What happens when a hurricane destroys commercial real estate? Or a megadrought wipes out a farm’s entire season’s worth of produce and their ability to repay a loan?

According to global management consulting firm Bain & Company, banks face two main types of financial risk from climate disasters like these:

- Damage to collateral, such as homes, factories, or farmland, which reduces the value of those assets.

- Counterparty defaults, as businesses or individuals lose the income needed to repay loans.

Bain estimates a 10–15% cost from physical risk exposure alone, and predicts that by 2050, 65% of land will be under some form of climate peril — up from 43% in 2023.

Banks that fail to factor in these risks may see their asset values erode and revenue streams disrupted.

Climate Risk as a Strategic Driver

Of course, planning with climate in mind is not just about avoiding loss; it’s about gaining competitive advantage, as well.

“Success in the new climate era hinges on our ability to integrate climate considerations into daily decision-making,” states J.P. Morgan in its Climate Intuition series. “Those who adapt will lead, while others risk falling behind.”

But most are falling behind. According to the Task Force on Climate-Related Financial Disclosures (TCFD), as of 2021, most of the 1,600 companies they reviewed — including financial institutions — were still unable to quantify the financial impact of climate hazards or gather the data needed to run scenario analyses. And many banks who have access to quality climate risk data, still cannot integrate that data into their decision-making because so much of it has not passed the rigorous model validation tests enterprise banks require in their model risk management (MRM) practices. This results in climate impacts being largely or completely unaccounted for in their projections, decisions and plans.

In a fast-moving risk landscape, that kind of blind spot can be costly.

From Reactive to Resilient: A Better Path Forward for Banks

To stay ahead, banks must move beyond historical averages and adopt tools that provide forward-looking, location-specific data on climate risk that can be deployed in production environments.

This is where many existing analytics models fall short; they cannot produce the decision-grade data necessary to meet the high standards of the banking industry – and they’re built for the past, not the future.

What’s needed is a proactive approach to climate resilience: one that allows banks to assess risk at a granular level, understand financial exposure, meet disclosure requirements, and build trust with regulators, investors, and customers alike.

Your Next Step: A Practical Guide for Climate-Ready Banks

Jupiter’s banking-focused whitepaper, “The Ultimate Guide to Climate Resilience in Banking,” is a practical resource for bank leaders looking to strengthen their risk models, investment decisions, and stakeholder reporting in the light of the changing climate.

.avif)

This guide includes:

- A look into the rising financial costs of climate events

- Top use cases for climate risk analysis in the banking sector

- Insights on how banks are shifting from reactive to proactive climate risk planning

- A readiness quiz so banks can self-assess their gaps in current climate risk planning

- A checklist for selecting the right climate risk partner

.webp)