Jupiter Adaptation Hub

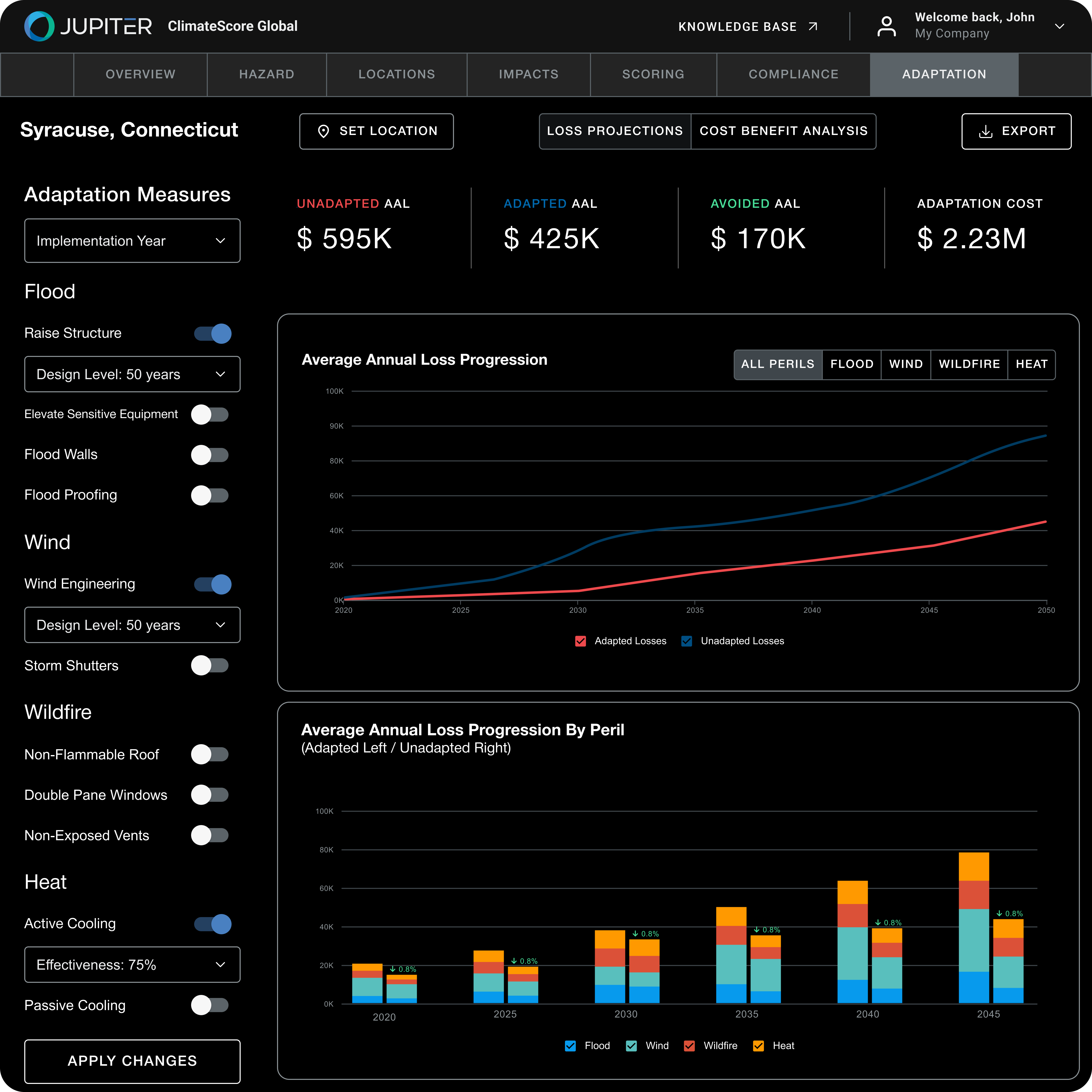

Jupiter’s adaptation capabilities represent a shift in how institutions approach resilience. For the first time, customers can quantify adaptation ROI with the same confidence they already apply to risk.

That means credible, customized insights on avoided losses, implementation costs, and site-level ROI – delivered within the trusted ClimateScore Global platform within the Jupiter Adaptation Hub. From deal teams to ESG leads, this is adaptation planning at the pace and precision of real investment strategy.

.webp)

Jupiter’s newest capability makes it easy to justify resilience investments with board-ready analytics.

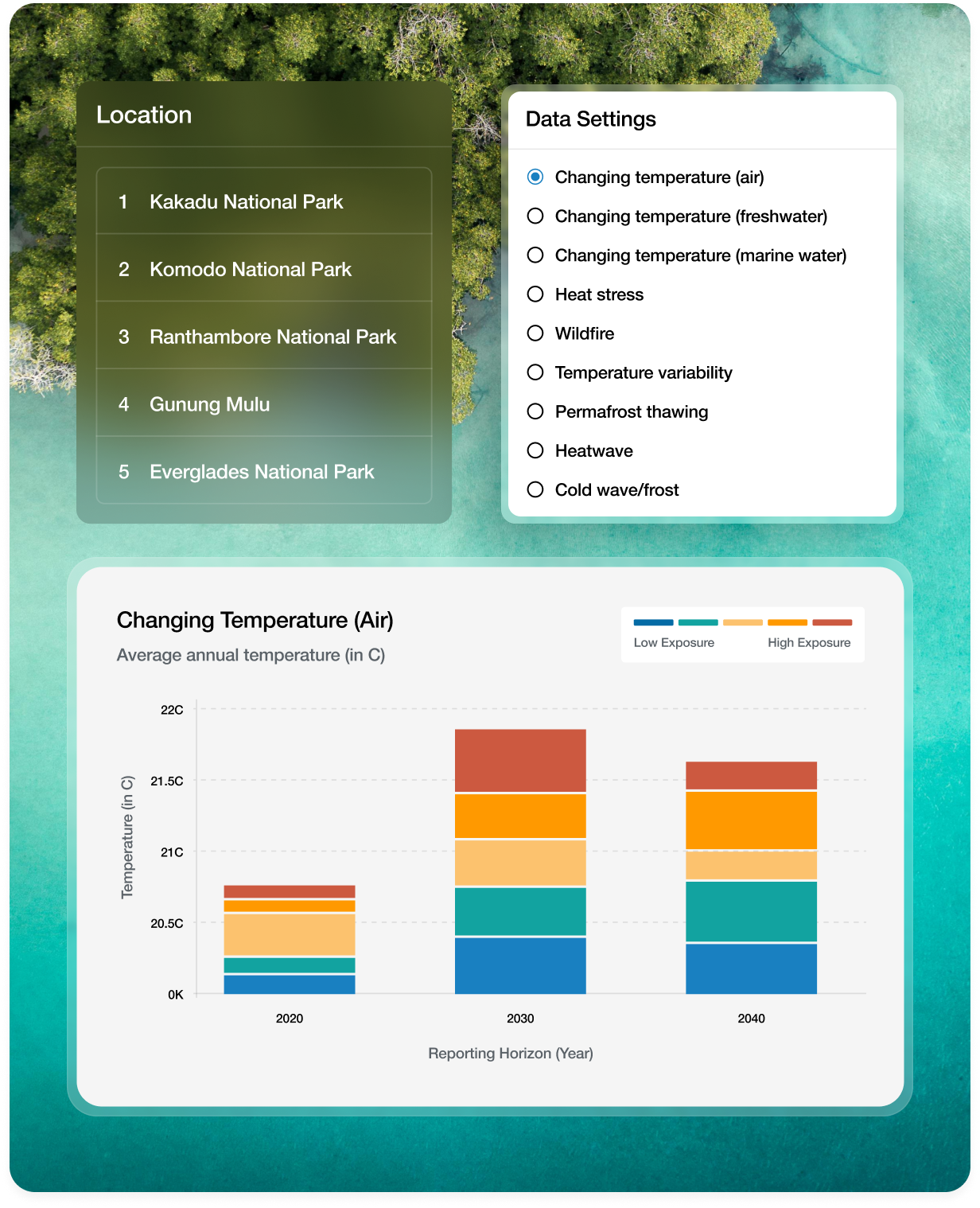

- A library of physical adaptation strategies (e.g., flood protection, wind retrofits, wildfire-safe retrofits, cooling systems)

- ROI modeling based on avoided loss vs. adaptation costs, with regional cost adjustments

- Interactive visualizations at asset, sub-portfolio, or portfolio level

- Outputs that include unadapted vs. adapted loss, avoided loss, and ROI over 1-, 5-, 10-, and 30-year horizon

Use case

Jupiter’s adaptation capabilities represent a shift in how institutions approach resilience. For the first time, customers can quantify adaptation ROI with the same confidence they already apply to risk.

That means credible, customized insights on avoided losses, implementation costs, and site-level ROI – delivered within the trusted ClimateScore Global platform within the Jupiter Adaptation Hub. From deal teams to ESG leads, this is adaptation planning at the pace and precision of real investment strategy.

A roadmap to climate risk disclosures

Stay informed on the latest regulatory developments and global trends. Jupiter experts continuously track climate risk regulations worldwide—check back regularly for the most up-to-date insights.

Use Cases

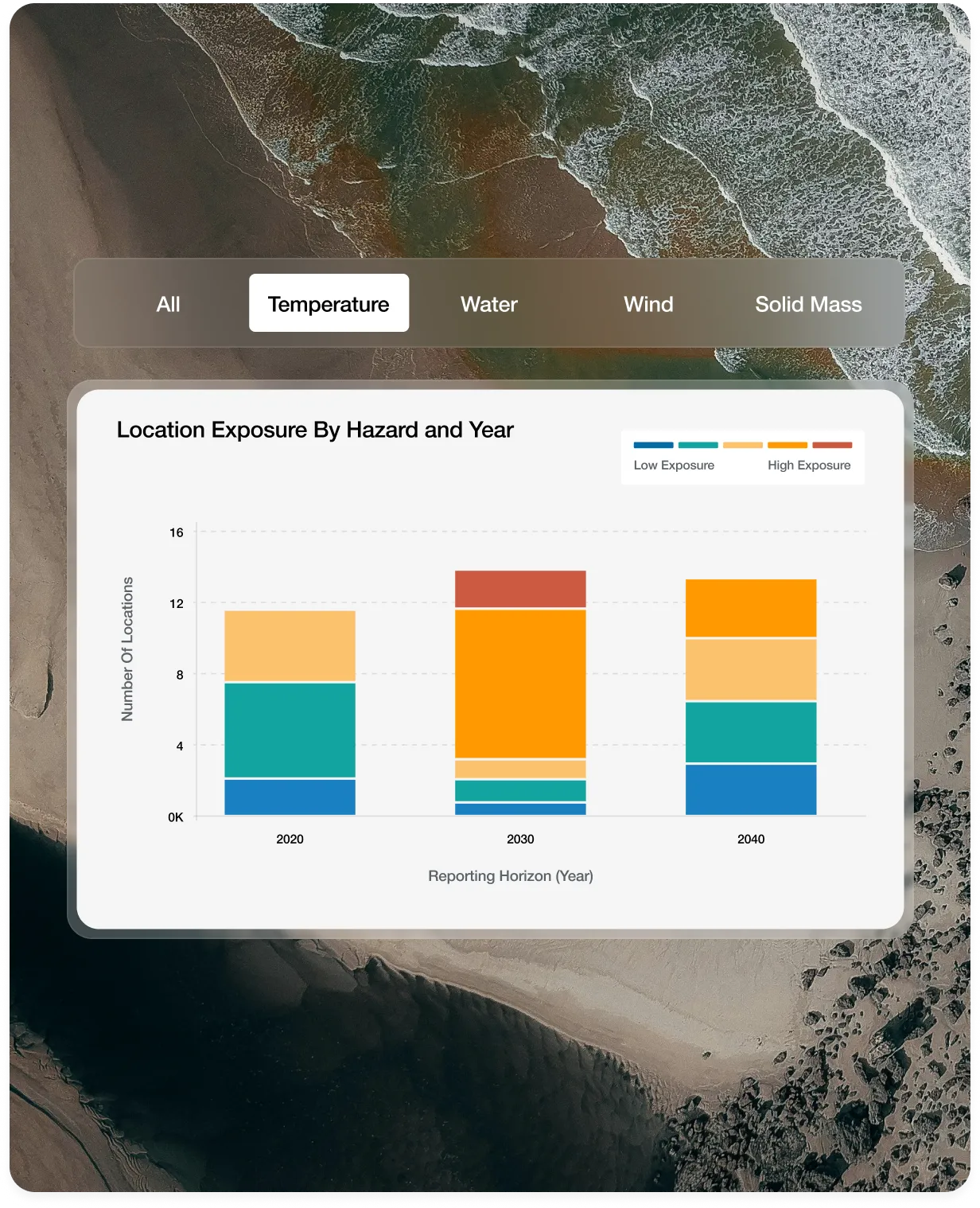

Portfolio Exposure Management

Quantify and benchmark exposure across assets and hazards to rebalance toward more resilient investments.

LP & Investor Reporting

Use defensible, auditable data to support resilience claims and standardize disclosure.

Due Diligence

Screen acquisition targets and benchmark them against resilient asset standards to avoid poor performers.

Resilience & Adaptation Strategy

Simulate adaptation measures and articulate resilience plans that can be communicated to LPs.

Investment Due Diligence

Evaluate climate-driven loss and exposure pre-acquisition to justify pricing, premiums, or walk-away decisions.

Asset Adaptation Planning

Identify key risks and simulate the ROI of adaptation measures to inform capex and hold/sell decisions.

LP/Board Reporting & Strategy

Communicate alignment with fiduciary duty through forward-looking, actionable resilience planning.

Insurance & Repricing Risk

Forecast premium changes, identify underinsured assets, and include insurability in investment calculus.

Site-Level Risk & Mitigation Strategy

Model specific adaptation strategies (e.g., floodwalls, wind retrofits, AC installation) to reduce losses and preserve asset value.

Financial Optimization

Use adaptation ROI to inform property-level improvements that protect net operating income and reduce future impairment.

Portfolio-Level Resilience Planning

Apply adaptation strategies at scale, compare effectiveness and ROI across holdings, and justify capex allocation.

[eBOOK] Climate Intelligence: The Untapped Alpha in Private Equity's Risk Assessment

Paired with a Jupiter expert that specializes in your industry, we will work together to assess your needs and determine the best-in-science physical climate risk analytics approach for your organization.

talk to an expert.webp)

.avif)

%20tiny.avif)

.avif)

.avif)