While it’s intuitively clear that climate risk is on the rise, it remains difficult to appreciate its real-world impacts. Regulators and investors have begun to force the issue, and businesses are increasingly being asked to be proactive and quantitative in their approach to climate resiliency. But where should they start? How can businesses move beyond qualitative scores to an understanding of the tangible impacts of climate change on their operations?

Deciphering the Climate Risk Workflow

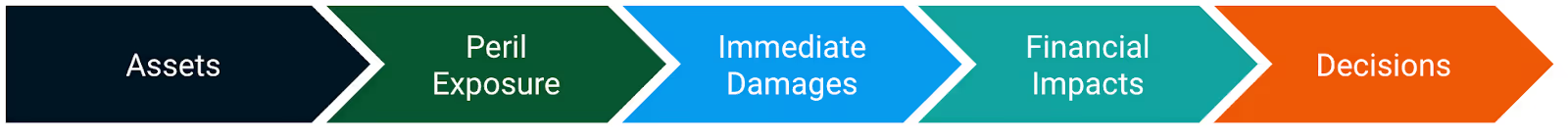

Every business has assets, whether owned or invested in. As climate patterns evolve, these assets are susceptible to a variety of environmental threats, ranging from hurricanes and floods to wildfires and heatwaves. These climatic events can lead to immediate economic ramifications, further spiraling into broader financial implications, such as operations impacts, decreasing asset values, and heightened credit risk. It’s imperative to understand these financial trade-offs when designing a resiliency plan.

Let’s walk through this process for a hypothetical airline.

1. Set Clear Climate Risk Goals

Beginning a climate risk assessment demands clarity of purpose. While businesses might initially aim to only appease investors and regulators, the real value lies in analyses that move beyond disclosures. An airline might wish to lower operational disruptions during heat waves, track insurability risks, and reinforce the resiliency of its supply chain.

This step will also prompt you to identify the climate scenarios that you’ll consider. An airline might choose to disclose their physical climate risk under a favorable scenario like SSP1-2.6 while internally planning for a more likely scenario such as SSP2-4.5 and examining SSP5-8.5 as a stress test.

2. Identify Your Assets

Begin with your own offices, factories, transmission lines, and so on. Then, cast a wider net.

Beyond primary assets, consider the assets of your entire value chain: your suppliers, distributors, transportation lines, investments, and more could play a role. For an airline, that might start with owned assets and quickly move to airports and access roads.

Defining assets locks in another component of the analysis: over what timeframe should you be looking? This should at least extend to the remaining useful life of an asset or its holding time. For an airline, that could be 30-40 years for a plane and longer for permanent facilities.

3. Assess Damage Potential and Future Severity

Once you know the scope of your analysis, understanding the damage potential and its future severity is paramount for effectively strategizing for climate risk.

For example, it can take months to repair hurricane damage, so you’ll need to know some pretty specific things like how deep the water can get and how fast the wind will blow. Even if these are covered by insurance in the immediate aftermath, there could be other impacts on insurance rates and your reputation. Another example is how linear assets like power lines and rail networks behave during heat waves. The efficiency of these assets will likely diminish, and very specific peril metrics for certain time horizons, scenarios, and resolutions are required to model this.

For an airline, air temperatures and humidity, in particular, can have multifaceted impacts. An airline disclosed that taking off in hotter, thinner air requires reduced loads: six fewer seats at 110° F (43°C) and up to 35 fewer seats at 120°F (49°C). Airlines are also supported by ground crews, who require more breaks to safely work when heat and humidity—typically measured by Wet Bulb Globe Temperature (WBGT) or the heat index—breach critical thresholds. To understand the economic toll that this will take, the airline’s climate analysis should consider:

- Moving beyond an average temperature study to one that pinpoints the frequency of surpassing critical temperature and WBGT thresholds

- Granular, high-resolution metrics that can capture hyper-local phenomena such as a heat island on a blistering tarmac

- Economic models of the direct damages caused by each temperature threshold, wind speed, or flood depth surpassed

With these tools, the airline can project economic losses over time and weigh measures to reduce those consequences.

4. Make Better Decisions

The subsequent choices that you face are multifaceted: Do you adapt or implement mitigation strategies? Do you merely absorb the costs, or consider procuring additional insurance coverage? An encounter with extreme flooding, for example, causes immediate damages to your assets that must be repaired. Even if those damages are covered by insurance, it’s likely your insurance rates will increase, and possibly your ability to buy insurance at all. Furthermore, during that repair time, you may be losing revenue.

An airline might face an even more delicate balance: to combat projected losses due to extreme heat, should an airline spend money to develop planes with better resiliency in high temperatures? begin lobbying for increased capacity to land and take off at night at the most exposed airports? or simply plan to absorb the costs? Furthermore, the airline might plan to shift its strategy as the loss frequency grows over time.

Having the data to understand these domino effects equips you to consider all of your available options: making prudent financial decisions about insurance, engineering decisions such as constructing flood defenses, or value chain decisions such as diversifying your suppliers.

The Imperative of Precision

Precision is non-negotiable when dealing with climate risk metrics. The localized nature of many climate impacts, such as flooding, necessitates a highly detailed approach. Broad metrics, like average flood depths or temperatures across expansive regions, simply won't suffice. Whether it's assessing the specific temperature thresholds affecting aviation, predicting the intricate rainfall patterns impacting agriculture, or knowing the flood risk of a specific loading dock in your most critical warehouse, it is pivotal to use data that are of the highest possible resolution, that relate to your assets’ vulnerabilities, and that are projected for the future years and climate scenarios that match your analysis goals.

As the discourse on climate risk evolves, businesses equipped with the best climate science and its business translation will undoubtedly lead the way.

.webp)