.webp)

The Taxonomy’s Influence Extends Beyond the European Union’s Borders

by Megan Arnold

Competitive & Regulatory Intelligence Manager

Jupiter Intelligence

The EU Taxonomy is a climate risk disclosure landmark—and not just for those large companies within the European Union who must report by December 31, 2022.

The Taxonomy is important on several levels: it impacts a massive portion of the global economy; it has been years in development (even prior to its formal charter by the European Commission in March 2018); it will affect a growing number of reporting companies over its roll-out; and, like the TCFD framework, it will serve as a significant guidepost for regulators across the world as they formulate their own taxonomies and processes.

The EU Taxonomy is a classification system and common language designed to offer guidance on what constitutes “sustainable investment” in companies and sectors that support the EU’s environmental objectives. Companies that “get it right” in reporting climate risk under the EU Taxonomy will benefit as they comply with climate-related disclosures issued by national regulators or sector-related authorities.

As Jupiter is the global leader in physical climate risk modeling—and because it’s crucial that companies both understand the EU Taxonomy and act in a timely way—we’ve created a series of three, ten-minute webcasts in the run-up to its first major reporting deadline at year’s end. Our goal is to bring clarity to the Taxonomy’s requirements for physical climate risk and articulate how decision-useful climate risk data can be put to use, now, to address them.

Our second webcast, which I present, offers a high-level view of EU Taxonomy that places it within the context of other global initiatives that share its overall mission. In this blog, I’ll focus on the Taxonomy, and how climate risk disclosure using physical risk analytics such as Jupiter’s will be useful this year, and in future years, as regulations take effect in the EU and other jurisdictions. If you wish to jump ahead to the video, you can use this blog as a companion.

Growing Impact Within the EU

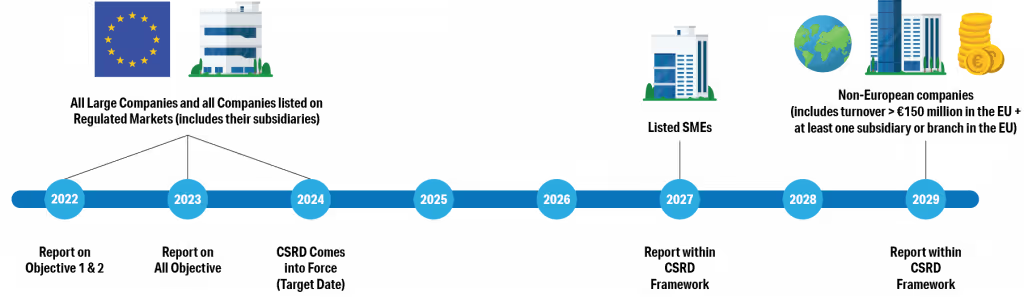

As my colleague Elisa Seith noted in her webcast, the EU Taxonomy, and the Corporate Sustainability Reporting Directive (CSRD) based upon it, will come into force over the next six years. During that time, CSRD will gradually impact a larger pool of companies: publicly traded smaller- and medium-sized entities by 2027, then non-European companies with medium-to-large footprints within the Union.

Superior climate risk reporting based on best-in-science data can be applied to future reporting requirements under the EU Taxonomy, CSRD, and other EU instruments.

The Taxonomy’s Significance and Context Outside the EU

However, the Taxonomy cannot be viewed in a disclosure vacuum. By autumn 2022, climate stress tests for banks, insurers, and asset managers have been completed, or are underway, by the Bank of England, European Central Bank, and Monetary Authority of Singapore. Other countries are developing taxonomies—including the UK, Chile, and South Africa—and referencing the EU Taxonomy as a significant precedent.

Alignment with the framework established by the Task Force on Climate-Related Financial Disclosure (TCFD) is also a significant driver behind conducting best-practice climate risk assessments. The use of TCFD for voluntary, “comply or explain,” or required disclosures is increasing: European companies have taken the lead in embracing the TCFD framework in their ESG reporting; TCFD has been adopted by the UK and Switzerland, major economies that lie outside the EU; and TCFD alignment is anticipated to be a foundational principle of still-under-construction, jurisdiction-specific regulations in Canada, Hong Kong, New Zealand, Singapore, and the United States.

Companies who conduct climate vulnerability assessments in line with the EU Taxonomy’s requirements will be well positioned for future TCFD-aligned ESG reporting, and for mandates from financial regulators in their respective countries.

How Jupiter Data Supports Climate Risk Assessments

Jupiter Intelligence is uniquely suited to climate risk assessment for four main reasons:

- Our climate analysis is based on the most thorough and state-of-the-art climate models and provides the most reliable and scientifically sound projections.

- Our flagship product, ClimateScore Global, covers the majority of the EU Taxonomy’s required climate hazards at 90-meter (portfolio-scale) resolution; in addition, it enables users to project potential climate impacts until 2100 in five-year increments, and across three different climate change scenarios.

- ClimateScore Global’s unique combination of aggregated hazard scores and 75 detailed peril metrics allow easy identification of portfolio-wide risk and the assessment of expected impacts in depth.

- Jupiter partners with some of the world’s biggest consultancies and auditors, to provide a full range of services for sustainability reporting if needed.

Let Us Help You Prepare for the EU Taxonomy Mandate

The EU Taxonomy is a critical development—whether you’re reporting by the end of 2022, or later in the decade. Its influence will be felt beyond the EU’s borders. I urge that you watch (or rewatch) our webcast series, and visit the EU Taxonomy hub on our website. You’ll be able to talk to a Jupiter expert about how to use our data and services in your regulatory disclosure activities, see ClimateScore Global in action, and download a use case/overview.

We’re committed to helping you prepare for the Taxonomy and the regulatory mandates to come.

Megan Arnold is the Competitive & Regulatory Intelligence Manager at Jupiter Intelligence.

Jupiter Intelligence is the global leader in climate analytics for resilience and risk management. For further information, please contact us at info@jupiterintel.com.

.webp)