The PRA’s updated climate expectations move firms from disclosure to defensibility—requiring decision-grade analytics, capital integration, and governance that proves resilience under forward-looking climate scenarios.

The Shift: From Principles to Examinable Requirements

The Prudential Regulation Authority (PRA) has raised the bar.

With the transition from SS3/19 to SS5/25, climate risk management is no longer a principles-based exercise. It is now an examinable supervisory requirement tied directly to business-model resilience, capital adequacy, and solvency.

For banks and insurers, this changes the conversation:

- Climate risk must be mapped across transmission channels

- Scenario analysis must be forward-looking and decision-relevant

- Models must meet Model Risk Management (MRM) standards

- Results must feed into ICAAP and ORSA

- Governance must show how analytics drive action

This is not about producing better disclosures. It is about proving that climate risk is quantified, governed, and capitalized.

Decision-Grade Scenario Analysis Is the New Test

The PRA is explicit: running a scenario is not enough.

Running a scenario isn’t enough—the PRA will ask whether it changes capital decisions.

Supervisors will ask whether scenario outputs change pricing, provisioning, portfolio steering, and capital planning.

That requires:

- Event-based and probabilistic analysis

- Full loss distributions, not single scores

- Compound hazard modeling

- Clear time-to-breach metrics

- Transparent assumptions and uncertainty

Scenario analysis must be fit for financial decision-making, not just reporting.

Independent benchmarking shows wide dispersion across vendor outputs driven by differences in geocoding precision, vulnerability assumptions, and metric definitions—making defensibility a core supervisory concern.

Reverse Stress Testing: Finding the Breaking Point

A PRA-endorsed technique is reverse stress testing.

Instead of asking how climate risk affects the portfolio, firms start with a failure condition—such as a CET1 breach—and work backward to identify the climate pathways that could cause it.

This approach:

- Reveals hidden concentrations

- Forces clarity when vendor estimates diverge

- Links breach conditions to management actions

- Strengthens recovery and resilience planning

Defensibility is no longer a reporting feature. It’s a model-risk requirement.

It also creates a direct bridge to adaptation finance.

By identifying the combinations of hazard, exposure, and vulnerability that threaten capital, firms can evaluate targeted resilience investments—quantifying avoided loss, protecting collateral value, and improving solvency outcomes.

Reverse stress testing, in this sense, becomes a tool for prioritizing funded resilience actions, not just diagnosing risk.

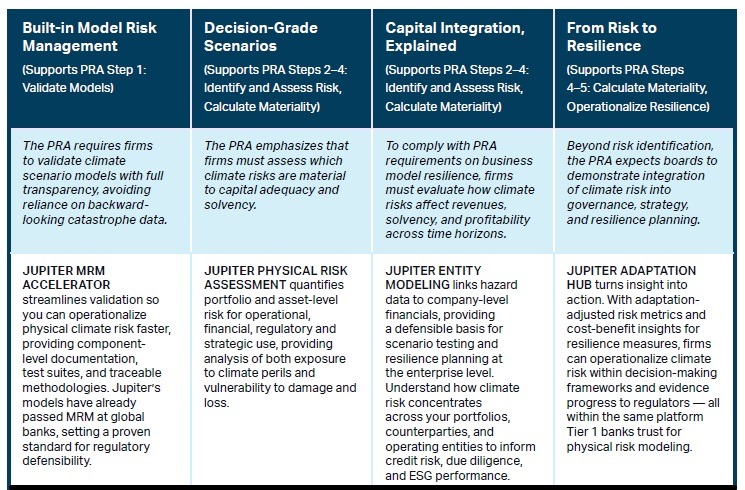

The Five-Step PRA Process—Operationalized

The PRA framework translates into a clear execution pathway:

1. Validate climate models under MRM

Climate models must be explainable, documented, and governed like any material risk model.

2. Map exposure with precision

Location accuracy, asset representation, and explicit assumptions are critical to defensible outputs.

3. Run forward-looking scenarios

Firms must assess materiality across multiple horizons using climate science—not historical extrapolation.

4. Translate results into capital terms

Analytics must roll up from asset to enterprise and inform ICAAP/ORSA narratives.

5. Embed climate into strategy and governance

Boards must show how climate insights change underwriting, lending, pricing, and portfolio construction.

Materiality is the bridge between analytics and action. If climate results do not influence capital decisions, supervisors will question whether the risk is truly embedded.

This is also where adaptation finance scales—linking physical risk metrics to capex planning, credit structuring, insurance strategies, and client engagement tied to resilience milestones.

From Disclosure to Defensibility

The PRA makes one point clear: data gaps are not an excuse. Firms are expected to build interim capabilities while progressing toward a fully governed, decision-grade framework.

That means:

- Transparent methodology

- Quantified uncertainty

- Clear data lineage

- Sensitivity testing

- Documented limitations

Defensible analytics allow firms to move beyond exposure reporting to capital allocation, pricing discipline, and resilience investment planning.

The Strategic Edge of Early Compliance

Early movers gain more than supervisory readiness.

Firms that validate models, map exposures accurately, and run capital-relevant scenarios can:

- Reprice risk sooner

- Steer portfolios proactively

- Strengthen investor and ratings confidence

- Reduce model-risk challenges

- Improve ICAAP/ORSA outcomes

Early compliance turns climate governance into a balance-sheet advantage.

Just as importantly, they can deploy capital into adaptation measures that protect asset values, reduce loss volatility, and create new financing opportunities.

When analytics are examinable and tied to decisions, supervisory scrutiny shifts from adequacy to strategy.

Compliance becomes a balance-sheet advantage.

Enabling Decision-Grade PRA Alignment

Jupiter supports PRA-regulated firms with:

- MRM-ready climate models with full documentation and validation artefacts

- High-resolution, forward-looking hazard data across multiple perils and scenarios

- Entity-level financial linkage from asset exposure to capital impact

- Adaptation analytics that quantify avoided loss, resilience ROI, and capital benefits

This enables firms to move from exposure mapping to capital-relevant action, embedding climate risk into governance, strategy, and funded resilience programs.

Turning Mandate into Momentum

The PRA’s climate mandate is not a disclosure exercise—it is a test of whether firms can manage climate risk as a core financial risk.

Those that build decision-grade analytics, integrate them into capital processes, and finance resilience will not only meet supervisory expectations—they will lead the market.

Download the eBook

The PRA Climate Risk Mandate: Turning Supervisory Expectations into Strategic Advantage

Learn how to:

- Align climate analytics with ICAAP and ORSA

- Meet MRM requirements with defensible models

- Run forward-looking, capital-relevant scenarios

- Translate physical risk into adaptation finance decisions

.webp)