Climate risk is no longer a disclosure exercise. For banks, it is a balance-sheet issue — one that affects credit quality, collateral value, capital planning, and long-term profitability. Forward-looking climate intelligence is what enables institutions to move from identifying exposure to executing resilient lending, underwriting, and investment strategies.

Risk Is Already on the Books

Physical climate risk affects banks in two direct ways: it damages collateral and weakens borrower creditworthiness. That means higher loss-given-default, mispriced assets, and hidden concentrations across portfolios.

Historical data alone can’t capture these dynamics. The extreme events shaping future losses don’t exist in backward-looking datasets, making forward-looking, asset-level modeling essential for accurate pricing and risk selection.

Climate risk is no longer theoretical — it is embedded in credit, collateral, and capital decisions.

Three Decisions Every Bank Must Make

Leading banks are integrating climate analytics into three core workflows:

Portfolio Management

Asset-level hazard data reveals where risk is accumulating, how it evolves over time, and which exposures threaten default probability and asset value.

Due Diligence

Climate-informed underwriting identifies mispriced assets, uncovers resilient opportunities, and supports entity-level financial impact modeling.

Stress Testing

Scenario-based analysis quantifies potential loan losses, operational disruption, and insurance cost shifts across credit, portfolio, and infrastructure risk.

The question is no longer “Where is our exposure?” but “How does climate risk change our loss curves and capital allocation?”

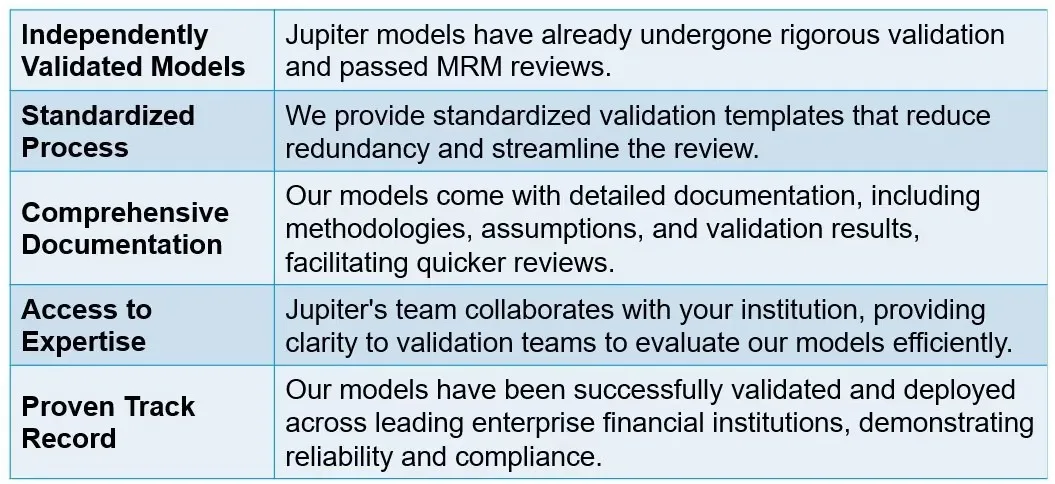

MRM: The Gate Between Insight and Capital

For banks, climate data cannot influence lending or capital decisions until models pass internal Model Risk Management (MRM) validation.

MRM ensures transparency, reproducibility, and scientific defensibility — turning climate analytics from exploratory insight into production-grade risk infrastructure.

This is the inflection point:

- Pre-MRM: climate data informs strategy discussions

- Post-MRM: climate models drive pricing, underwriting, and portfolio optimization

MRM approval is what transforms climate analytics into decision analytics.

From Compliance to Competitive Advantage

Banks that operationalize climate intelligence gain measurable advantages:

- More accurate credit pricing and risk selection

- Earlier identification of vulnerable collateral

- Stronger regulatory and disclosure readiness

- Faster deployment of capital into resilient assets

In a market where climate-resilient opportunities are scarce, speed matters. Institutions that validate and integrate climate models first will capture the highest-quality assets and avoid stranded risk.

The Shift from Data to Decisions

Climate resilience in banking is not about adding another dataset. It requires:

- Forward-looking, high-resolution modeling

- Asset-level financial impact quantification

- Integration into enterprise risk frameworks

- Alignment with MRM and regulatory expectations

With that foundation, banks can move from reactive loss management to proactive capital strategy — protecting portfolio value while identifying new sources of return.

MRM-Approved Climate Analytics for Real-World Banking

Climate analytics only create value in banking once they pass Model Risk Management (MRM) and can be used in production decisions.

Jupiter is built for that moment.

With peer-reviewed science, transparent methodologies, and reproducible results, Jupiter enables banks to move climate models through internal validation and into real-world workflows — underwriting, credit pricing, stress testing, and capital planning.

That means climate intelligence can be applied directly to:

- Quantify impacts on collateral value and loss given default

- Integrate forward-looking risk into credit and portfolio models

- Run climate-adjusted stress tests across scenarios and time horizons

- Support regulatory and disclosure requirements with audit-ready outputs

Instead of remaining in exploratory analysis, climate risk becomes a production input — one that informs lending decisions, portfolio steering, and capital deployment.

"Jupiter allows us to quantify the risk and integrate within our risk management framework."

— A Top-Tier Global Development Bank

This is how banks turn validated climate models into defensible credit action and competitive advantage.

Download the eBook

The Ultimate Guide to Climate Resilience in Banking provides a practical framework for integrating forward-looking climate analytics into portfolio management, due diligence, stress testing, and MRM-aligned risk workflows.

.webp)