By Sébastien Burgess, Senior Principal Solutions Architect, Jupiter

.avif)

DP World is a critical player in the global trade ecosystem. Based in Dubai, DP World works up and down the logistics value chain in cargo logistics, port terminal operations and other maritime services.

Operating 82 terminals in over 40 countries, DP World handles 70 million containers annually, contributing to about 10% of global container traffic.

DP Word’s extensive global operations footprint exposes its activities to a wide range of potential climate peril risks including and not limited to high winds, heat extremes, and acute flooding.

DP World worked with Jupiter Intelligence and Guidehouse, a Jupiter partner company, to systematically assess direct physical climate risks and quantify the financial impact to port and terminal (P&T) operations across six hazards: flood, precipitation, wind heat, cold and hail examined across three emissions scenarios.

In a new study published and co-authored by DP World, Jupiter and Guidehouse, we highlight our joint approach to leverage Jupiter’s gold standard climate projections to develop a risk and vulnerability model assessing disruption to P&T operations and the associated loss in revenue.

This model was based on three critical components:

- Hazards - Climate projections provided by Jupiter highlighting which hazards are likely to occur in the port today and in the future. This data was the vital core from which all further insights were derived.

- Exposure – An Asset Resilience Working Group developed a list of 24 asset categories that are most essential to ports, including workers, cranes, quay infrastructures and other categories.

- Vulnerability – A per-hazard asset failure mode was defined and individual ports were surveyed to understand maximum operating thresholds. For example, a maximum operating wind speed threshold for a quay crane is typically around 70km/hr.

To compute expected financial loss from climate extremes, the model also took into account asset criticality (the percentage of P&T revenue loss when the asset is not operational) and the extent of downtime experienced per extreme weather event.

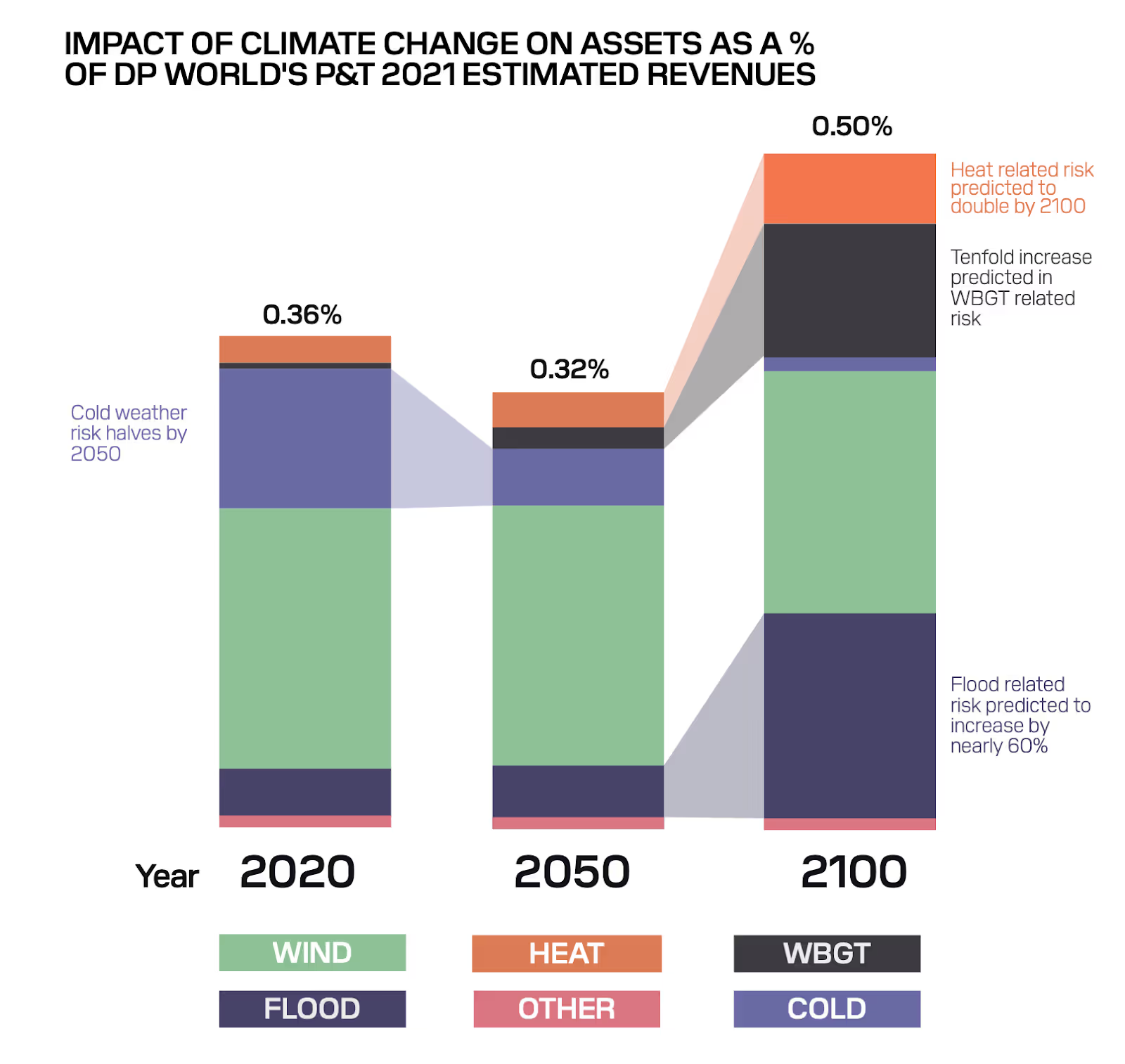

This study first allowed DP World to establish that ~50% of the current total direct physical climate risk is driven by wind, followed by cold (~30%) and flooding (~10%). This initial hazard mapping exercise allows DP World to establish priorities in with core hazard risk drivers.

Second, because cold risk is expected to materially decrease across all scenarios by 2050, the impact of climate change on assets as a percentage of DP Word’s estimated revenues is actually projected to decrease by 2050. However, by 2050 and into the end of the century, impact on revenue is projected to increase driven by a higher frequency and intensity of extreme weather events, particularly driven by flooding and heat-related events.

The report was careful to highlight that despite a projected decrease in revenue impact by 2050 at the portfolio level, seven individual ports concentrated in emerging markets are still projected to experience increased downtime in the years leading up to 2050.

Climate risk assessments like the one carried out for DP World represent a critical first step to managing climate adaptation and resilience. They also highlight the urgency of progressing to next steps across the global trade landscape in assessing indirect risk to the industry. Logistics infrastructure is entirely reliant on roadways and rail, government-funded emergency response systems as well as operational power, energy and water utilities infrastructure. Future extreme weather events will create cascading impacts across the interdependent global trade network and the wide array of upstream and downstream supply chain partners. The Suez Canal obstruction in 2021 is a useful example to understand the susceptibility of the industry to a single bottleneck, when six days of business interruption caused over $60B in global trade losses.

DP World’s risk assessment with Jupiter and Guidehouse provides a repeatable, scalable blueprint to collectively manage risk across the global trade industry. This existing assessment will form the basis for future updated studies which will include remedial actions to increase asset resilience and generate longer-term benefits and savings.

Read more about climate intelligence from Jupiter or contact us to discuss how physical climate risk is impacting your business and its value chain.

Sebastien Burgess is the Senior Principal Solutions Architect at Jupiter.

.webp)